what state has the highest capital gains tax

Invest in Silicon Valley Real Estate. Maine has the third highest state tax burden.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Here is a list of our partners and heres how we make money.

. And this is a decrease from what it once was. This is more than. The average combined federal state and local top marginal tax rate on long-term capital gains in the United States is 286 percent 6 th highest in the OECD.

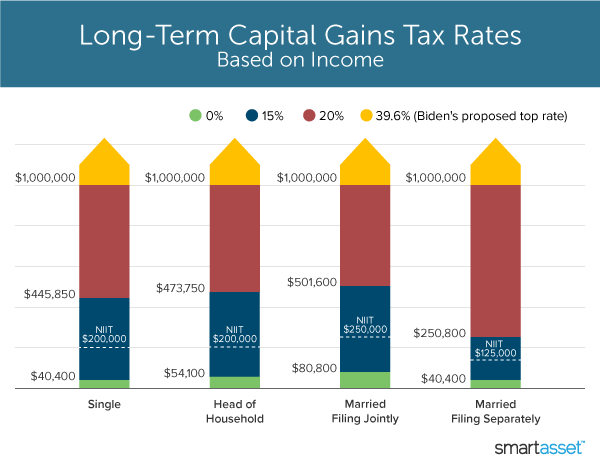

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. But the wealth of. Iowa residents pay 90 percent state tax on capital gains and 296.

Ad If youre one of the millions of Americans who invested in stocks. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and. As I previously reported the Washington state capital gains tax has had a turbulent ride commencing with a rough ride through the legislative process where it almost hit.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. Or sold a home this past year you might be wondering how to avoid tax on capital gains. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments.

Connecticut 154 percent and Hawaii 149 percent followed. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. When July 8 passed last week so did the deadline for filing signatures on the.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. However the combined state and federal capital gains tax rate for Idaho residents is 294 percent. Long-Term Capital Gains Taxes.

New Yorkers faced the highest burden with 159 percent of net product in the state going to state and local taxes. 51 rows These states typically make up for their lack of overall tax income with higher sales. Invest in Silicon Valley Real Estate.

In the United States of America individuals and corporations pay US. The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309. Californias state-level sales tax rate remains the highest in the nation at 725 as of 2021.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. In the 1970s the top capital gains rate inched into the 30 range and ultimately reached a peak of 35 in 1979 according to research from Wolters Kluwer.

The most common types of state and local taxes are personal income taxes sales taxes capital gains taxes and property taxes. California Sales Tax. The future of Washingtons capital gains tax is in the hands of Washington State Supreme Court.

Real Estate Capital Gains Taxes When Selling A Home Including Rates Capital Gain Real Estate Articles Sale House

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Is Capital Gain Tax Incapable Of Levying Upon Registration Of Sale Deed Know How Capital Gains Tax Capital Gain Tax

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Rates By State Nas Investment Solutions

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Capital Gains Tax Rates By State Smartasset

2022 Capital Gains Tax Rates By State Smartasset

2022 Capital Gains Tax Rates By State Smartasset

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Do State And Local Individual Income Taxes Work Tax Policy Center

Chart Do You Pay A Higher Tax Rate Than Mitt Romney What Is Credit Score Rich Kids Rich Kids Of Instagram

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)